In Germany, retailers must comply with many legal requirements. These include procedural documentation, which must be available when the tax office arrives. It serves as a kind of manual for the tax auditor, enabling him to quickly gain an impression of the organizational processes, the IT systems used for financial accounting and the security precautions taken.

Although procedural documentation tends to be somewhat neglected, it is mandatory and must be kept in view of the KassenSichV also information about the used TSE as well as to the audit-proof archive contain. The KassenSichV applies wherever cash register processes relevant to sales tax occur. It therefore applies not only to retailers but also to waste disposal companies (Settlement at the scales) or public administrations (e.g. ticket sales in cultural offices). Everyone has the obligation to prepare procedural documentation! In principle, according to GoBD, since 2015 every entrepreneur subject to accounting and recording obligations must provide procedural documentation.

What are the advantages of creating procedural documentation?

The procedural documentation is the ideal preparation for a tax audit or cash inspection: Since 2018, the tax office can check the compliance of your cash registers during business hours without prior notice. An up-to-date procedural documentation serves the auditor as a first orientation about the cash register system, BUT also you yourself. This way, you know with one hundred percent certainty where your data goes, through which systems and who has access authorization, for example. The latter becomes important at the latest when you have to export data and make it available.

What does the procedural documentation consist of?

This is where many companies flounder, as there are no legal requirements for the structure of the procedural documentation. However, there is a GoBD proposal for the "table of contents" that can be used as a guide. It comprises five parts:

- General part

- User documentation

- Technical system documentation

- Operating documentation

- Internal Control System (ICS)

The external form of the procedural documentation is a closed document with a meaningful table of contents. A division into two parts is recommended:

- Masterfile: Descriptions of the systems and processes

- Appendix: Work instructions, protocols and ICS

A General part

Description of the company's business activities and tax obligations, clarification of responsibility for as well as a change and versioning concept for the procedural documentation.

- General conditions and business environment for the application of the relevant IT systems i.e. area of activity and economic sector of the company

- Determination of profit (balance sheet or EÜR)

- occupational specifics (e.g. archiving requirements for physicians)

- Description of local conditions for accounting-relevant processes, e.g. where paper documents are scanned in

- Description of the storage location of paper occupancy or destruction location in case of "replacing scanning".

- Regularity of document digitization (daily, weekly, monthly)

- Listing of any external service providers involved

- Authorized responsibilities in electronic bookkeeping

- Notes on changes in renewed procedural documentation versions

A flowchart of the most important processes of electronic accounting, including document storage and recording of business transactions, is recommended.

B User documentation

Description of the technical processes involved in electronic accounting, including ancillary systems.

- Acquisition of data in the system (manually or automated from external sources),

- Checking and reconciliation of data for correctness (manual check or automatic plausibility checks),

- Output of the data (paper printout or electronically via further processing systems or external options).

In addition, it must be explained how and according to which rules the data transfer between the different systems works.

C Technical system documentation

Hardware:

- Server systems

- Hardware used at workstations, e.g. laptops, etc.

- Auxiliary and secondary systems such as (e.g. scanner for digitization)

Software:

- all used programs incl. version and updates

- User history of previously used programs

- Information on customizing (individually adapted software)

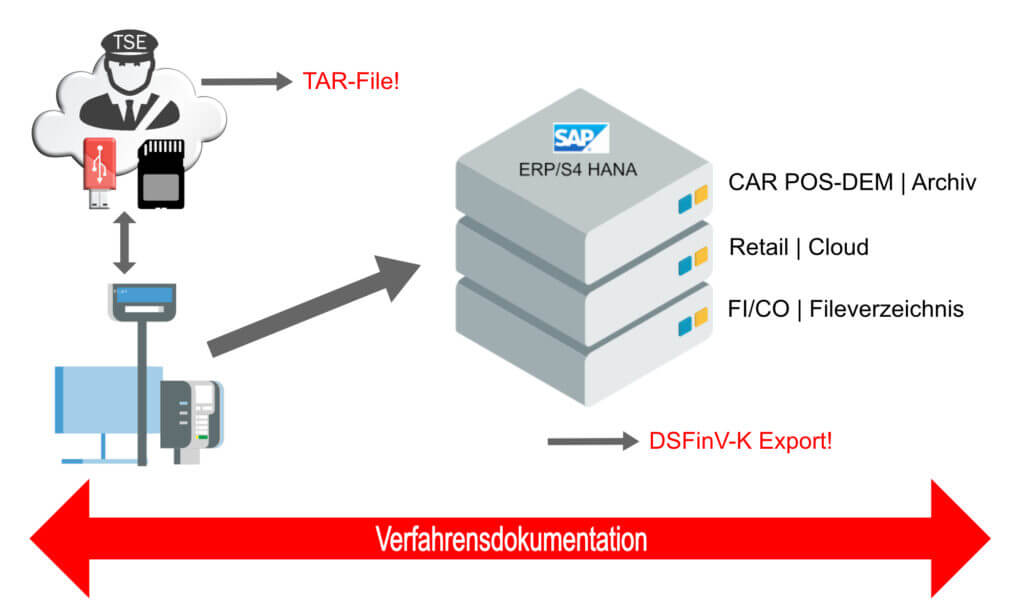

Individual components/system parts must be combined with their respective interfaces to form a comprehensible overall picture. The following example graphic illustrates the systems in SAP that may be affected:

D Operating documentation

The operational documentation includes the use of the systems used and their organization in the operation of the accounting-related software.

- Internal company instructions for documentation

- Internal regulations for the security of IT operations

- Description of the operational processes in normal operation

- Description of operational procedures during emergency operation

- Data security concept incl. rules for password generation

- Data backup concept

- User administration i.e. who is allowed to access what and with which authorization (read rights, write and read rights, delete rights, etc.)?

E Internal control system (ICS)

The internal control system is the usage rules for accounting-relevant IT structures, which are demonstrably logged and applied in the operational process.

The ICS must cover the following areas:

- Access and access authorization concepts

- Function separations

- Control of data collection and entry

- Transmission and processing controls for data use via interfaces (for automated transmissions)

- Protective measures against intentional or unintentional falsification of data

- Regularly logged, random plausibility and completeness checks (in addition to the standardized checks of modern IT applications)

Help with the creation of procedural documentation

It becomes obvious: The workload is not exactly small and increases the more branches, systems, processes and employees have to be taken into account. The good news is: If you are an SAP customer, we can help you with our AddOn Receipt4S® not only IT-technically with your revision-safe POS data management, but also support gladly with the production of a procedure documentation! You can find more information on this at receipt4s.com.

If you have any questions, please feel free to contact our managing director and POS data expert Stephan Kaup: