Cash register reporting obligation from 2025: What retailers need to know now - and how good preparation saves time and nerves

The electronic cash register reporting obligation came into force in Germany on January 1, 2025. It obliges retailers to register their electronic cash register systems with the tax office - exclusively digitally via the ELSTER portal. What sounds like a simple administrative task at first glance poses a number of challenges in practice - especially for companies with several [...]

Dreamboat Surprise - the retail event 2025

On June 5, 2025, the RetailOneSolution Network welcomes its guests to the "Traumschiff Surprise" event on the event ship Herr Walter in Dortmund harbour. This event combines networking, inspiring presentations and a maritime atmosphere in an extraordinary setting. You can look forward to exciting insights into digital innovations, trading strategies and tax compliance topics. Among other things, [...]

Success story: Efficiency and tax compliance at FRS KG

Digitalization does not stop at the shipping industry. FRS KG has used this change to optimize its processes on board. The new cash register solution plays a central role in this, not only making on-board sales more efficient, but also fulfilling complex tax requirements in various countries. In our latest success story, you can find out [...]

Effective cash register monitoring - how to achieve tax compliance!

Among accountants in the retail sector, there are few topics that require as much attention as tax compliance. And this is exactly where modern cash register monitoring comes into play - a real game changer for companies in cash-intensive industries! In our article for NWB Verlag's BBK (Betriebs-Berater Kasse), we show how a Tax Compliance Management System (TCMS) can [...]

BEG IV: Adjustments and simplifications for retailers

The Fourth Bureaucracy Relief Act (BEG IV) brings some significant simplifications and adjustments for retailers and other companies in the accounting sector. These changes are intended to reduce the administrative burden and increase efficiency in accounting and administrative areas. How does this benefit our customers and ourselves as process digitizers? Benefit 1: Shorter retention periods The retention period for [...]

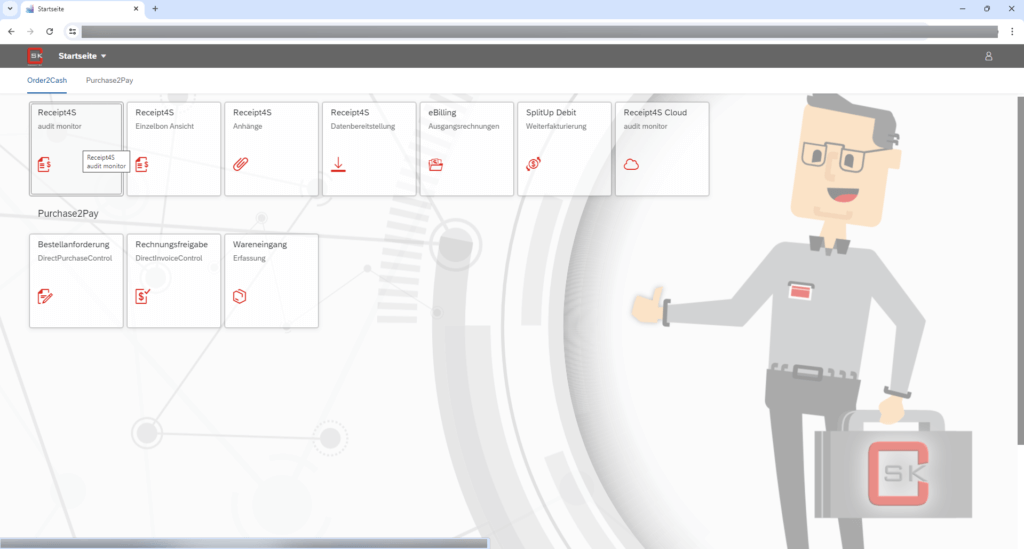

Discover Receipt4S® - now in the interactive Click Through Demo

What's better than listening to a lecture about benefits? Trying it out for yourself! That's why we've created a click through demo for Receipt4S®. This interactive demo allows you to experience the features and benefits of Receipt4S® first hand and understand why it should be an essential part of your internal control system for tax compliance. What [...]

WEBINAR | Knock, knock! Who's there? The tax office and it wants to see your cash register data!

Have you already run an audit simulation to make sure your fiscalization is running correctly? If not - and you are not alone - this webinar is just right for you! Because: The auditors of the tax authorities are now trained in the new audit software and are increasingly carrying out audits. These start with a cash register inspection, which can also be unannounced [...]

Audit simulation: Fiscal data correctly archived?

At the latest when a visit from the tax authorities is on the horizon, things start to get restless with regard to the archiving of cash register data. In our experience, the integration of a technical security system (TSE) is old hat, but only a few retailers and wholesalers have actually simulated an audit to find out whether their archived individual cash register transactions are complete and correct [...].

WHITEPAPER | Retail 2024: Tax Compliance and KassenSichV in SAP®

At the latest when a visit from the tax authorities is on the horizon, things start to get restless with regard to the archiving of cash register data. In our experience, the integration of a Technical Security Device (TSE) is old hat, but only a few retailers and wholesalers have actually simulated an audit to find out whether their archived individual cash register transactions are complete and correct with [...].

Tax compliance management: a safe bet with Receipt4S® in SAP

Every company is obliged to comply with statutory tax regulations. In retail, these regulations include GoBD as well as KassenSichV including DSFinV-K guidelines. Tracking whether these requirements are met is the task of tax compliance and includes the obligation to calculate and pay taxes correctly and finally submit a proper tax return. We help SAP users with this - with our unique [...]